Rivian (RIVN) shares hit a brand new yearly low on Monday, dropping almost 10%. Regardless of reaching its first gross revenue in This autumn, Rivian’s inventory is taking a beating attributable to combined analyst opinions. Right here’s what they’re saying.

Final week, Rivian launched its fourth quarter 2024 earnings, saying a gross revenue of $170 million. Though nonetheless a comparatively small quantity, it’s a large $776 million enchancment from This autumn 2023 and Rivian’s first optimistic gross revenue.

After shutting down its manufacturing plant in Regular, IL, final April for upgrades and launching its second-generation R1 autos, CEO RJ Scaringe stated the corporate is seeing “significant” price reductions.

“This quarter, we achieved optimistic gross revenue and eliminated $31,000 in automotive price of products bought per car delivered in This autumn 2024 relative to This autumn 2023,” Scaringe defined final week after releasing fourth-quarter earnings.

Rivian constructed 49,476 autos final yr and delivered 51,579. In 2025, the corporate expects barely fewer deliveries, projecting between 46,000 and 51,000 attributable to exterior components, together with altering authorities insurance policies. It additionally expects decrease EDV deliveries for Amazon after increased output in This autumn.

| Q1 2024 | Q2 2024 | Q3 2024 | This autumn 2024 | Full-12 months 2024 | 2025 steerage | |

| Deliveries | 13,588 | 13,790 | 10,018 | 14,183 | 51,579 | 46,000 – 51,000 |

| Manufacturing | 13,980 | 9,612 | 13,157 | 12,727 | 49,476 | N/A |

Some Wall St analysts are additionally involved about coverage modifications underneath the Trump Administration. On Monday, Financial institution of America analysts downgraded Rivian inventory to an Underperform ranking from Impartial following its This autumn outcomes.

The analysts additionally lower Rivian’s inventory worth goal to $10 from $13, saying the 2025 supply forecast was “softer than anticipated” and “there may very well be extra draw back threat if coverage modifications are enacted.”

Rivian inventory hit with a downgrade after This autumn earnings

Financial institution of America warned that new competitors from Lucid (LCID), GM’s Chevy, and VW’s Scout might impression gross sales projections over the following few years.

In the meantime, the memo did say Rivian continues to be “one of the viable” EV startups and the three way partnership with Volkswagen is “complicating earnings forecasts for at the very least the following 4 years” for forecasting. Rivian finalized its EV three way partnership with VW within the fourth quarter, value as much as $5.8 billion, of which Rivian will get $3.5 billion over the following few years.

A part of Rivian’s decrease 2025 supply forecast is because of plant upgrades coming on the finish of the yr for its extra inexpensive R2 SUV. Beginning at $45,000, the R2 will likely be almost half the price of the present R1S and R1T.

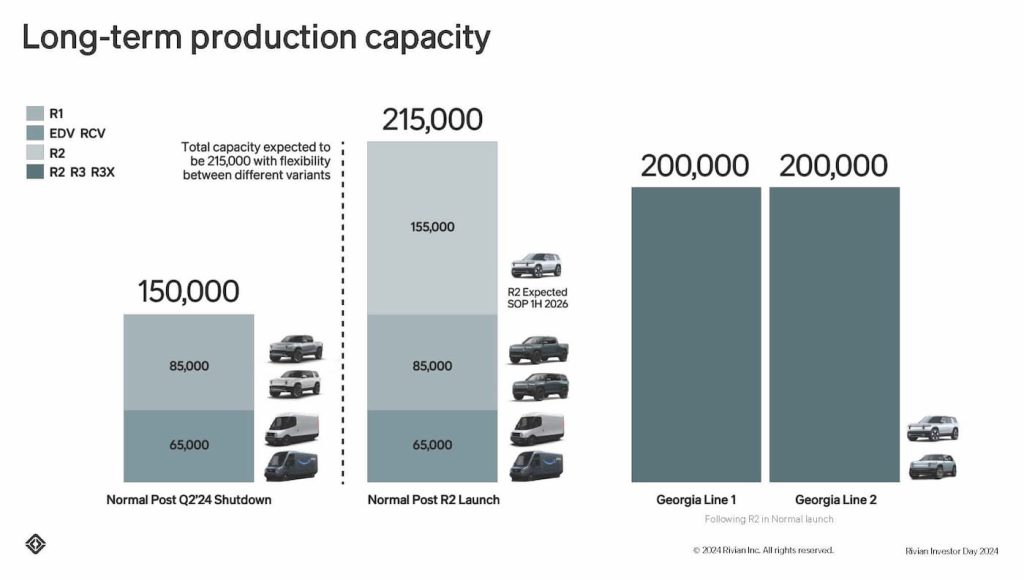

Rivian plans to start R2 manufacturing early subsequent yr in Regular however expects output to considerably ramp up at its new EV plant in Georgia.

Regardless of closing on its mortgage settlement for the US DOE for as much as $6.6 billion final month, the funding is up within the air with Trump threatening to freeze federal loans.

“Given the Trump Administration’s give attention to cost-cutting, we consider there may very well be a threat to RIVN’s $6.6 billion Division of Power mortgage closed by the Biden Administration on Jan 16,” Financial institution of America analysts stated.

Regardless of the downgrade, a number of analysts upgraded the inventory. Needham raised its worth goal from $14 to $17, whereas Wells Fargo bumped theirs as much as $14 from $11 with an “Equal-Weight” ranking.

Rivian’s inventory was down over 8% on Monday following the downgrade. At round $11.90, nevertheless, Rivian shares are nonetheless up 11% over the previous yr.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.