It’s been extensively reported that electrical automobile (EV) gross sales development has slowed this 12 months, however new knowledge from the third quarter exhibits continued development within the sector, as backed by incentive packages and a greater variety of choices accessible to shoppers this 12 months than the previous few.

In response to Kelley Blue Guide estimates reported by Cox Automotive in a press launch final week, EV gross sales within the U.S. grew 11 p.c 12 months over 12 months in Q3—reaching document highs in each general market share and complete supply quantity.

Whole EVs bought within the third quarter reached 346,309, marking a 5-percent leap from Q2. In the meantime, complete EV market share reached 8.9 p.c in Q3, which is the best degree recorded but and marks a leap from 7.8 p.c in the identical quarter final 12 months.

“Whereas year-over-year development has slowed, EV gross sales within the U.S. proceed to march increased,” stated Stephanie Valdez Streaty, Cox Automotive’s Director of Trade Insights. “The expansion is being fueled partly by Incentives and reductions, however as extra inexpensive EVs enter the market and infrastructure improves, we will anticipate even higher adoption within the coming years.”

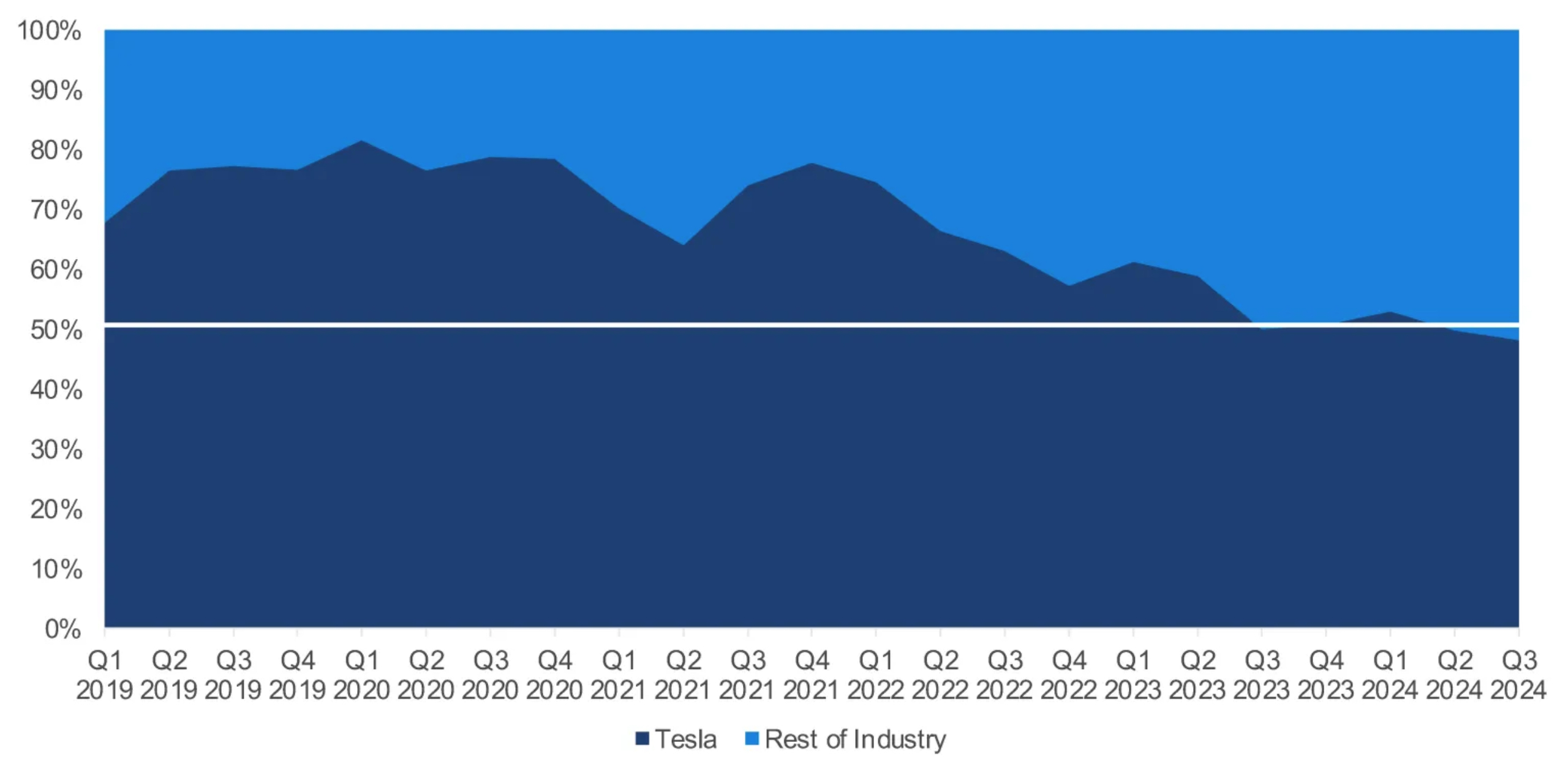

Tesla’s share of complete EV gross sales vs. the remainder of the business

Credit score: Cox Automotive

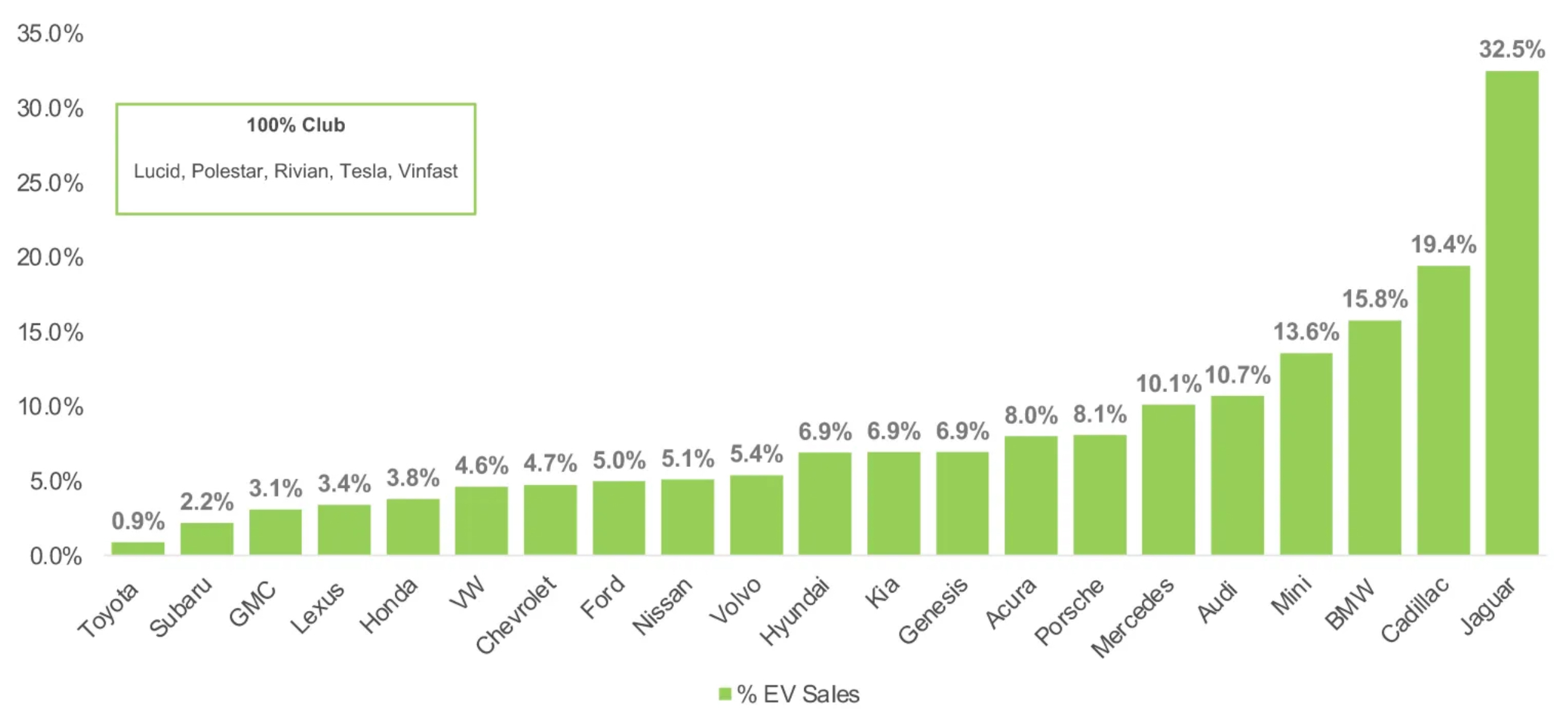

Q3 EV Share of Whole Model Gross sales

Credit score: Cox Automotive

Cox says it expects elevated development within the coming months, and it says market share of 10 p.c is “properly inside attain,” particularly with elevated charging infrastructure and EV choices available on the market, in addition to nice incentives and reductions.

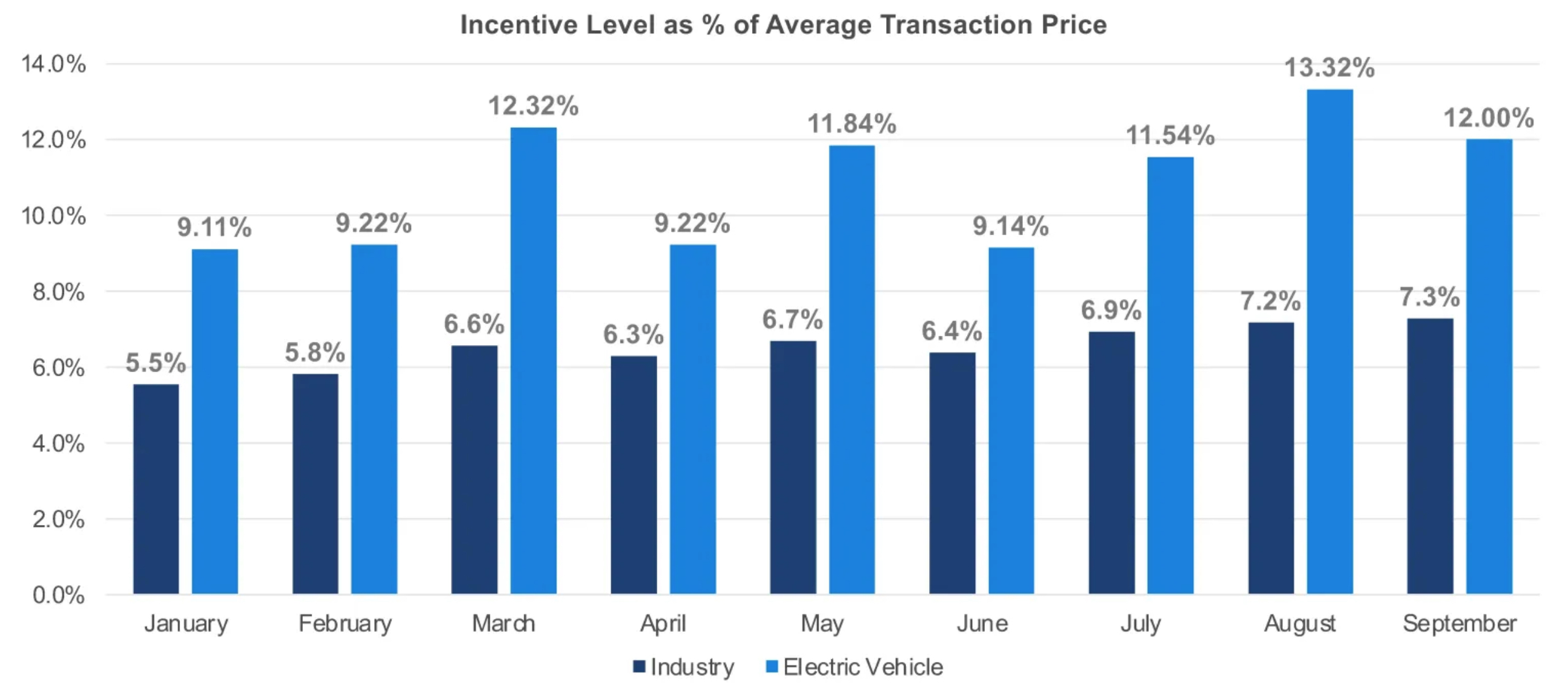

EV incentives additionally reached a excessive within the third quarter, together with leasing packages that gave automakers entry to much more beneficiant authorities incentives. Throughout Q3, incentives averaged over 12 p.c of the Common Transaction Worth (ATP) on gross sales, above that of the business common of round 7 p.c.

Cox reported in July that incentives had reached a three-year excessive at about 11.54 p.c of the ATP on gross sales, earlier than climbing even increased in August to 13.32 p.c. It dropped off once more barely in September, touchdown at 12 p.c of the ATP.

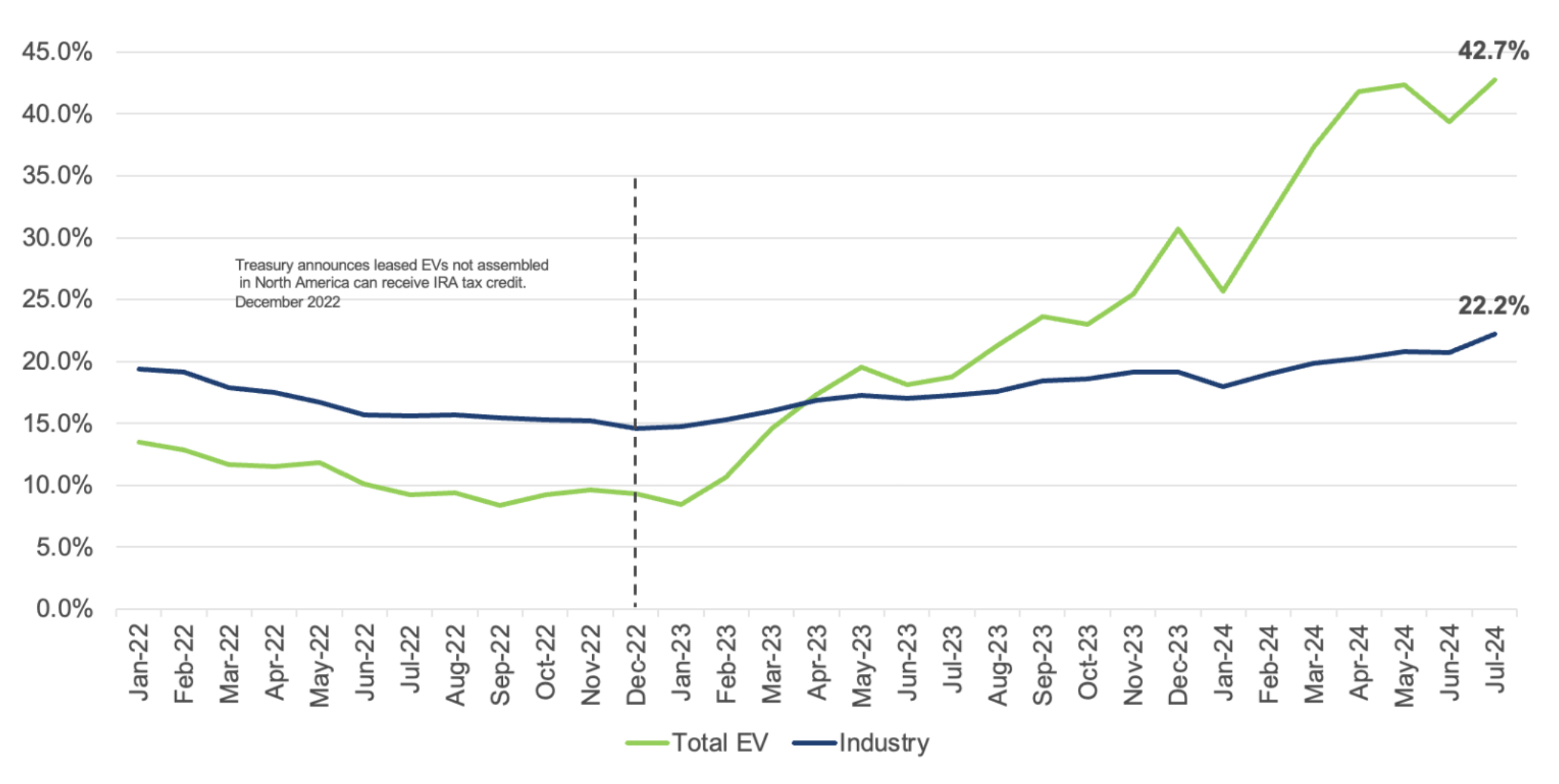

EV Lease penetration of retail gross sales vs. business

Credit score: Cox Automotive

Credit score: Cox Automotive

Tesla has remained the clear EV market chief, although shopper choices have continued to extend, together with the market share of different automakers trying to ramp up their EV packages. In Q3, Tesla delivered 166,923 automobiles within the U.S., marking a 6.6 p.c improve 12 months over 12 months.

The report additionally notes that Tesla returned to development mode in Q3 with gross sales leaping 6.6 p.c, as supported by the more and more fashionable Cybertruck. Tesla bought 16,692 Cybertrucks in Q3, outselling each different EV except for the Mannequin 3 (58,423) and Mannequin Y (86,801).

As for particular person manufacturers, Tesla was adopted by Ford and Chevy in Q3, which bought 23,509 and 19,933 EVs, respectively.

Notably, Basic Motors (GM) EVs general noticed a 60-percent leap to 32,095 complete models throughout manufacturers, and surpassed Hyundai, which noticed gross sales plateau 12 months over 12 months at 29,609 models.

You’ll be able to see the complete knowledge from Cox Automotive right here.

Consultants talk about the remaining hurdle to EV gross sales

What are your ideas? Let me know at [email protected], discover me on X at @zacharyvisconti, or ship us ideas at [email protected].