Ford is slashing one other 4,000 jobs in Europe because it struggles to maintain tempo with the market’s shift to electrical autos (EVs). The American automaker stated a “extremely disruptive” EV market and new competitors are inflicting important losses within the area. Ford’s announcement comes as China’s main EV maker, BYD, is shortly catching up in international deliveries.

Ford is chopping extra jobs in Europe amid EV struggles

“Ford has been in Europe for greater than 100 years,” the corporate’s European vp for Transportation and Partnerships, Dave Johnston, stated on Wednesday.

Because the market shifts to EVs and new competitors arises, Ford is preventing for its share. The corporate has incurred “important losses” lately amid a “extremely disruptive” inflow of latest EV challengers.

Ford plans to chop one other 4,000 jobs in Europe by the tip of 2027 as a part of its restructuring. The corporate blamed the “weak financial state of affairs” and “lower-than-expected” demand for electrical automobiles.

The deliberate cuts will primarily have an effect on Germany, however some may also have an effect on the UK. Ford stated in a press launch that different European markets will see “minimal reductions. “

Ford can also be slowing the output of its new electrical Explorer and Capri, each of which have been constructed at its revamped Cologne EV plant in Germany.

Final week, German newspaper Kölner Stadt-Anzeiger (through Automobilwoche) reported that the plant’s staff could be placed on short-term work hours. A Ford spokesperson confirmed the transfer, citing a “quickly deteriorating” EV market.

Ford confirmed the plans on Wednesday, saying it’s going to end in short-term working days on the Cologne plant within the first quarter of 2025.

An pressing name to motion

In a letter to the German authorities, Ford’s CFO, John Lawler, reiterated the corporate’s dedication to Europe and the 2035 emissions goal. Nonetheless, he additionally issued an pressing name to motion for all stakeholders to work collectively to advance the transition. Lawler added:

What we lack in Europe and Germany is an unmistakable, clear coverage agenda to advance e-mobility, reminiscent of public investments in charging infrastructure, significant incentives to assist shoppers make the shift to electrified autos, bettering price competitiveness for producers, and better flexibility in assembly CO2 compliance targets.

Regardless of the restructuring, Ford nonetheless desires to be a participant in Europe. The following era of Ford autos in Europe will likely be “software-defined” with a “differentiated” design.

The corporate will concentrate on its business Ford Professional enterprise whereas competing in choose passenger car segments to drive revenue development.

Ford invested $2 billion into its Cologne plant to organize it for EV manufacturing. After the first electrical Explorer rolled off the meeting line in June, Ford added its second EV, the brand new Capri, simply final month.

The American automaker has drastically downsized management in Germany this 12 months. Earlier this month, Ford misplaced two of its most skilled management crew members. It’s now down to 2 administrators from 9 earlier this 12 months.

Electrek’s Take

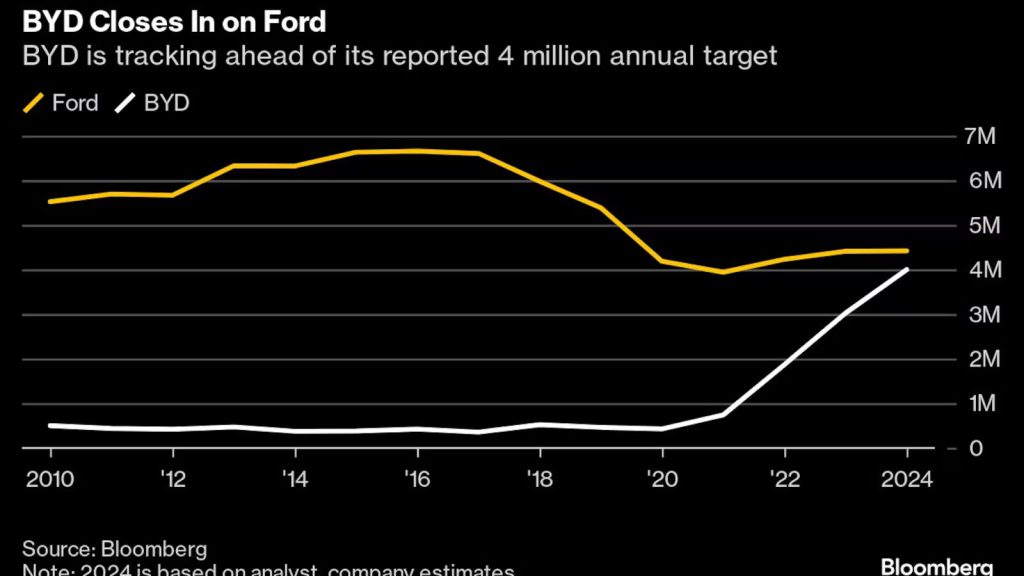

Ford’s restructuring in Europe comes as EV leaders, like China’s BYD, proceed gaining floor within the international auto market.

After dominating its dwelling market, BYD and different Chinese language EV makers are wanting abroad to drive development.

BYD is already a number one EV model in key areas like Southeast Asia and Central and South America, nevertheless it expects gross sales to speed up within the subsequent few months. The EV large opened its first manufacturing plant in Thailand earlier this 12 months, and extra are deliberate for Hungary, Brazil, Mexico, Pakistan, and Turkey.

In response to Bloomberg, BYD is quickly approaching Ford in international deliveries. Though BYD is greatest recognized for its low-cost EVs, like the Seagull, which begins at below $10,000 (69,800 yuan) in China, it’s shortly increasing into new segments like pickup vans, mid-size SUVs, and luxurious fashions.

Ford’s CEO Jim Farley warned rivals earlier this 12 months that in the event that they fail to maintain up with the Chinese language, “20% to 30% of your income is in danger.”

“Because the CEO of an organization that had bother competing with the Japanese and the South Koreans, we’ve to repair this downside,” Farley stated.

Whereas Ford’s Mannequin e EV unit is on observe to lose between $5 billion and $5.5 billion this 12 months, BYD simply reported a document $1.6 billion (RMB 11.6 billion) in Q3 web revenue amid surging EV gross sales. October was BYD’s eighth straight document gross sales month, with over 500,000 passenger autos offered for the primary time.

Ford is betting on smaller, extra inexpensive EVs to show issues round with its new low-cost platform. The primary EV mannequin powered by the platform, a brand new electrical truck, is due out in 2027.

Can Ford flip issues round? Or will or not it’s too little too late? Tell us your ideas within the feedback under.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.