Tesla (TSLA) will launch its This fall 2024 and full-year 2024 monetary outcomes on Wednesday, Jan. 29, after the markets shut. As traditional, a convention name and Q&A with Tesla’s administration are scheduled after the outcomes.

Right here, we’ll take a look at what the road and retail traders anticipate for the quarterly outcomes.

Tesla This fall 2024 deliveries

Whereas Elon Musk and his loyal shareholders wish to say that Tesla is now an AI/Robotics firm, the corporate’s automotive enterprise nonetheless drives its financials.

Earlier this month, Tesla disclosed its This fall 2024 car manufacturing and deliveries:

| Class | Manufacturing (models) | Deliveries (models) | Working Lease Accounting (%) |

| Mannequin 3/Y | 436,718 | 471,930 | 5 |

| Different Fashions | 22,727 | 23,640 | 6 |

| Complete | 459,445 | 495,570 | 5 |

This quarter, deliveries got here considerably deliveries beneath Wall Avenue’s expectations.

Now that power storage is beginning to contribute to Tesla’s income extra meaningfully, the corporate has additionally began sharing deployment in its quarterly supply and manufacturing numbers.

This quarter, Tesla confirmed that it deployed 11 GWh of power storage by means of its Megapack and Powerall merchandise – a brand new document.

Tesla This fall 2024 income

For income, analysts typically have a fairly good thought of what to anticipate, because of the supply numbers, and now the power storage deployment knowledge.

Nevertheless, issues have been more and more troublesome as Tesla’s common worth per car is altering regularly nowadays on account of frequent worth cuts and reductions throughout many markets.

Analysts needed to readjust over the previous few weeks after Tesla’s deliveries got here underneath their expectations. Now, in addition they must account for power storage, which achieved a brand new document. Vitality storage revenues ought to obtain a brand new document, however perhaps not as excessive as some consider as a result of Tesla has reduce Megapack costs during the last yr.

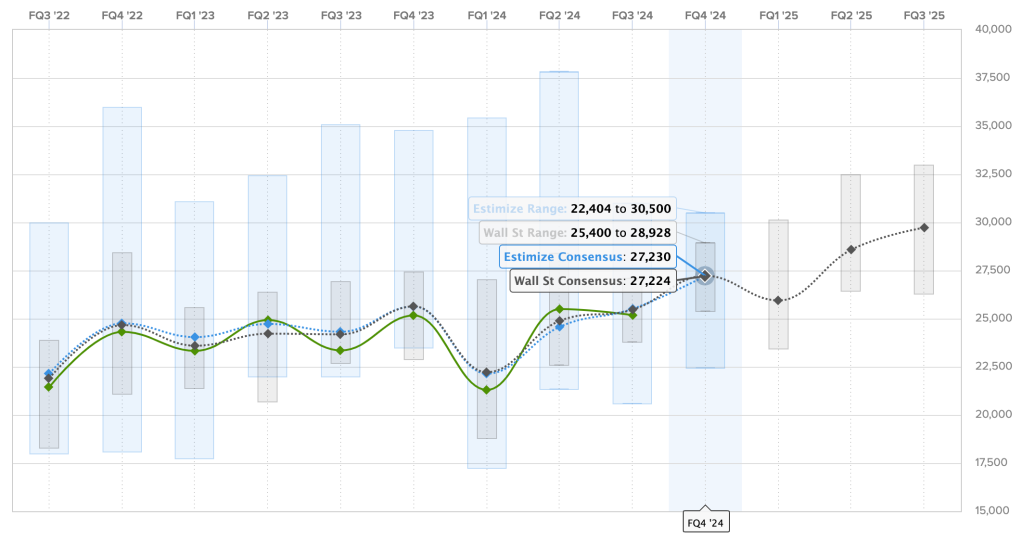

The Wall Avenue consensus for this quarter is $27.224 billion, and Estimize, the monetary estimate crowdsourcing web site, predicts a slighty greater income of $27.230 billion.

Listed here are the predictions for Tesla’s income over the previous two years, with Estimize predictions in blue, Wall Avenue consensus in grey, and precise outcomes are in inexperienced:

Final quarter, Tesla missed on income, however they’re anticipated to be greater this quarter whereas the expectations are affordable.

Tesla This fall 2024 earnings

Tesla at all times makes an attempt to be marginally worthwhile each quarter because it invests most of its cash into development, and it has been profitable in doing so during the last three years.

Like revenues, it has been more durable to estimate earnings over the previous few years, with worth cuts and backed loans lowering Tesla’s industry-leading gross margins.

This fall can also be typically totally different as a result of Tesla typically accumulates and promote extra ZEV credit, which may considerably increase its earnings.

For This fall 2024, the Wall Avenue consensus is a achieve of $0.77 per share and Estimize’s crowdsourced prediction is somewhat greater at $0.79.

Listed here are the earnings per share during the last two years, the place Estimize predictions are in blue, Wall Avenue consensus is in grey, and precise outcomes are in inexperienced:

Final quarter, Tesla had a major beat in EPS in comparison with expectations on account of decrease prices, which was shocking as a result of the corporate had guided greater prices just some months prior.

Different expectations for the TSLA shareholder’s letter and analyst name

Yesterday, I shared a listing of all probably the most upvoted shareholder questions which can be more likely to be requested through the convention name following the earnings outcomes.

Unsurprisingly, they need to know concerning the newest unsupervised self-driving timelines and Optimus, which Musk has framed because the packages that can flip Tesla into “the world’s Most worthy firm.”

I’d hope that some shareholders and Wall Avenue analysts would ask how Musk’s respectable into insanity is affecting the corporate, however I don’t need to get my hopes up.

In actuality, the principle factor that might drive Tesla’s share worth up from feedback or statements made through the earnings are associated to the brand new cheaper fashions based mostly on Mannequin 3/Y that Tesla is meant to launch within the coming months.

They’re the one factor proper now that may flip Tesla’s automotive enterprise again to development.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.